For the past ten years, I’ve been getting more and more into stock trading and long term investing. As I’ve become more diverse in what I select to invest in – mostly publicly traded companies like Apple, Netflix, or Square – I have even been blessed to have the opportunity to invest in other ventures like Hyper Island.

It can be a bit daunting to jump into investing, but I developed a couple of simple rules I follow that have helped me a lot. (Note: I sometimes fail at following them, oops!) Though they may seem extremely naive, you’d be amazed at the valuations these investments have that don’t pass the test.

1. The company sells a product I understand.

There are countless times when I’ve been intrigued by a rumour or a “common perception” that predicts a company is about to skyrocket. Later, I realise that it didn’t happen for reasons I couldn’t predict or even understand. Even the tech industry has areas that I don’t understand – and certainly can’t predict – but at least I have a fairly good understanding of what makes a good tech product. For instance, I stay out of biotech, source materials and retail investments because I have little to no understanding of how they work. Investing in what you don’t understand is not that different than playing the lottery.

2. The company sells a product I like.

There are products I understand (like Facebook), but I don’t particularly like. To be honest, I’ve been entertaining the idea of leaving Facebook altogether, because I don’t really enjoy the product very much. So why would I invest in a product I don’t like, regardless of how profitable they might be?

3. The company has a viable business model.

This might seem like a no-brainer, but there aren’t that many companies listed that don’t have a viable business model. However, there are companies like Twitter that have struggled for years to find a business model that actually works. Part of the problem here is that the companies that offer valuation services rely heavily on KPIs like MAU (Monthly Active Users) and MNU (Monthly New Users) rather than economics. Other companies like Uber might have a business model but are heavily dependent on finding loopholes in local law regulations. It’s simply not viable in the long term.

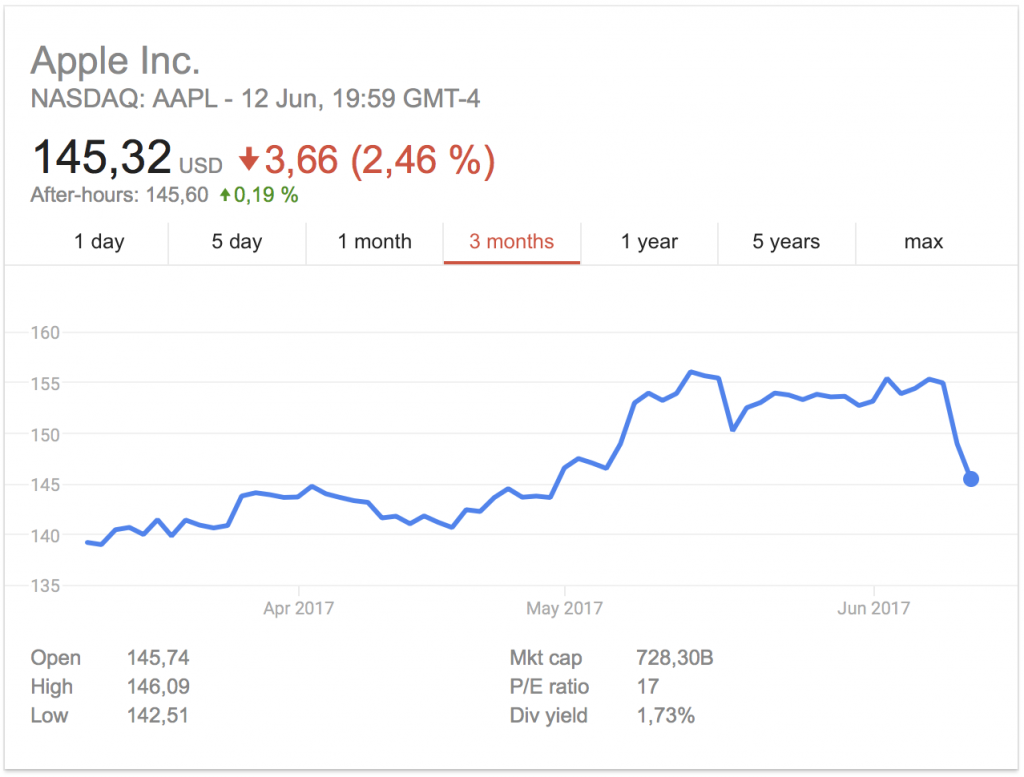

While these three simple rules might seem so basic, you’d be amazed at how hard it is to find companies that can check off all three requirements. Because of the recent stock market downturn, I’ve sold off most of my tech investments, but when I get back in I might stick to two or three of my favourites: AAPL and NFLX (perhaps SHOP too). I’d love to see Stripe and Mailchimp go public, so I could invest in them as well. Using Mailchimp to automate my email communications and Stripe for easy, inexpensive payment processing has streamlined what I do. They have proven their product, have made me like them and shown their viability. They would be an easy choice for investment.

This leads us to think about if our own products can check off these three requirements. Do people understand your product? Can you explain it in 30 seconds or less? I’ve seen basic apps fail at this because they want to explain everything. Is your product likeable to the point that someone would WANT to use it? Does it solve their problems and have a good plan for future growth? Your future investors will ask these questions too. Time to start answering them!

If you’re interested in investing, check out Samwise from Lisa and Dan. Love new fintech-startups like these.